If you are a buyer and feeling like you are in a really hot market, I have bad news for you, this is not a hot market.

A hot market is when buyers make compromises because they feel if they don’t buy this week, next week will be more expensive. In that market, it is a matter of evaluating the compromises and adjusting price expectations to get a home; FOMO sets in and the market moves at a rocket’s pace.

That’s not our market today. We are in a discerning market that can feel hot for some people, especially on the homes without apologies, but homes that have compromises are stuck wondering why they aren’t getting the traction like other neighboring homes.

It's understandable why you may think the market is hot – it’s possibly what you’re hearing from friends and your news feed, which tends to dictate the narrative. With interest rates at the lowest point since 2022 you would expect more excitement about the market trajectory, but then you see an article claiming of bad signs for the economy.

So how do you sift through the information to make an informed decision?

When I look around, I see a newer economic cycle with a ton of tailwind that will be driving our economy for a while – I like to think I’m not being blindly optimistic about the way technology is changing the way we work and live, but rather recognize there will be monetary benefit and along the way a lot of wealth will be distributed.

I clearly remember the dot.com boom and what I saw as the cycles – it starts with passion: people wanting to create cool technology to better the world or leave their mark, this is in the early time of the cycle (arguably where we are now), then we move to adolescence: when companies are pivoting and figuring out how best to monetize their product and company, similar to how we change as we go through adolescence.

Finally, we get to maturity: when people starting companies lose sight of doing it for the love, but rather just the money – the companies started at the tail end of the cycle tend to be strictly driven by how much they can make and you can feel the chill in the conversation and lack of passion. I use this analogy because I think it is important to remember another significant technological paradigm shift in recent history.

There are so many people currently itching to start their own company because of an idea that they think is better than the status quo, and that’s what I love to see. Most will fail, but we are working through our economy, and we will come out better on the other side.

How does this relate to real estate? So many people are moving back to the valley because this is the hub of innovation. That is setting us up for another hot market that will be very hard for buyers – I can tell you it’s coming, I just can’t tell you exactly when, but I want you to be prepared.

What’s Happening Now?

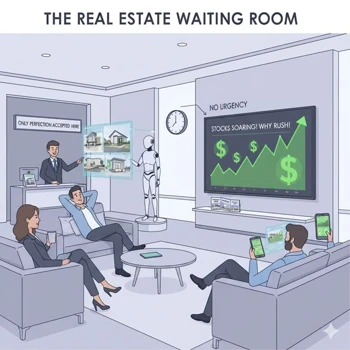

There is no shortage of buyers perusing the market, whether online or open houses, but they currently lack motivation; I’ll hear something like “I’m in no hurry,” or “I’m looking for the right home.” I argue the reason they aren’t in a hurry is because they don’t think the market is hot and their money is currently doing better in the stock market. The moment buyers think the real estate market is moving faster than the stock market, you’ll see a quick pivot and urgency will happen overnight. I’ve seen real estate cycles before and will see them again. I can understand why people feel this way – if I was a buyer and my down payment was sitting in tech stocks, I’d be hesitant to sell them as well. We have experienced a great run and it’s sensible to want to continue to experience those gains.

What is Certain is Uncertainty?

|

One thing is for sure, this year has been filled with uncertainty. Look no further than the tariffs, which seem to be changing daily and their actual impact on the economy is still unclear. Of course, tariffs aren’t the only uncertain dimension of our economy, just look at the job market and the administration’s rhetoric on immigration.

One thing is clear, our economy is segmented and unfortunately there is quite a divide making it difficult to lump national real estate into a single conversation -- you can argue national real estate is struggling for a number of reasons, but the demand in the valley is solid especially for turnkey homes (whether resale or rental market).

How long will the uncertainty keep the Fed from making big interest rate moves? A new Fed Chair is anticipated in 2026 that is friendly to interest rate cuts, so I’d expect aggressive cutting next year.

Uncertainty is certain for the foreseeable future, so we will have to watch each decision carefully and how it impacts our local real estate market.

I feel good about our economy going into 2026.

Fundamentally, I feel good about our local economy. The job market is solid, albeit there is a shift in workforce skills so it is more difficult to stick with status quo, there are new vertical growth opportunities for companies, we have a healthy stock market and the overall sentiment is positive, which all make for an optimistic outlook (if you keep politics out of the conversation). I even read a recent article about Home Depot year over year sales which were slightly up, which is quite encouraging to me in a year with so much uncertainty though the argument is being made that this is a bad sign because their sales aren’t up more. It’s not reasonable for a company like Home Depot to grow exponentially every quarter, even though that’s what the media and Wall Street may want you to believe.

Keep moving ahead because we are living in an exciting time, but don’t forget to look both ways because there will be obstacles to avoid.

_-_-_-_-_-_-_-_-_-_-_-_-_-_-_-

If you have a few moments, I encourage you to read my Winter 2024 Newsletter to compare my predictions to the actual year. You will find the advice given to my clients was timely and accurate. Continue reading for more insight for 2026.

Let's connect to talk more about the specifics of your exact situation: