SUMMER 2021 QUARTERLY BLOG

The economy is feeling good, and signs of normalcy are returning. There is no clearer barometer than the latest news from Costco that they are bringing back free samples in June! I expect this to be a strong summer with tons of euphoric attitude and plenty of spending across the board. Get ready for one crazy summer!

Where is the Money Going?

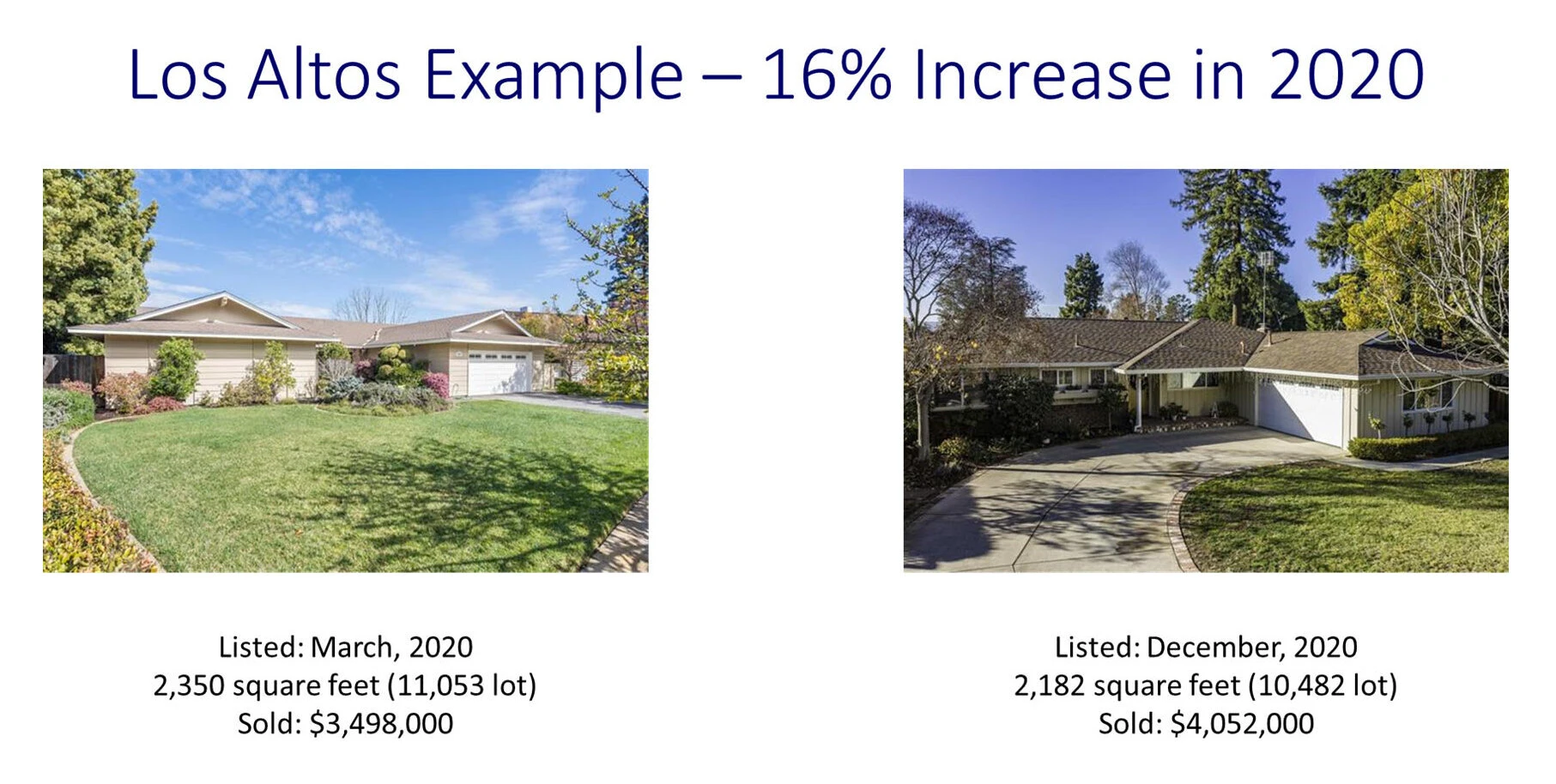

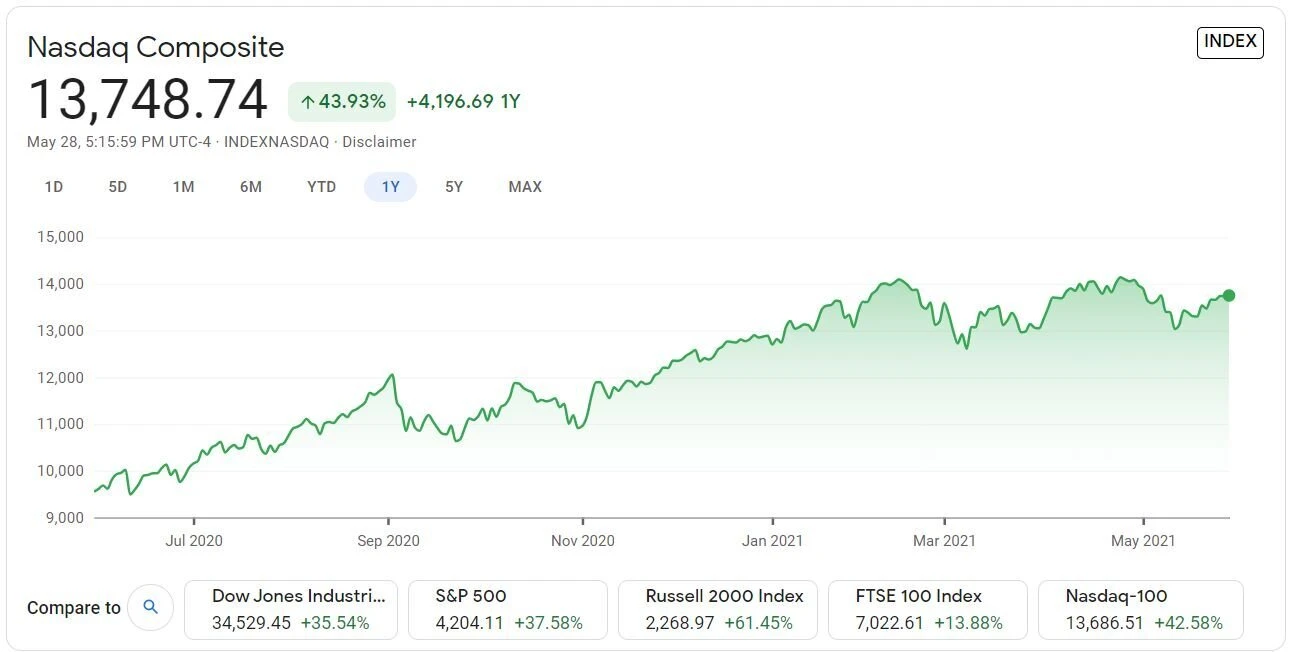

Over the past decade FAANG stocks were the clear winners, but real estate has not been so cut-and-dry. Not only has real estate growth been nominal compared to those companies, but prior to 2020, large estate properties (i.e., Atherton, Woodside and Los Altos Hills) had been struggling as most buyers wanted the urban lifestyle in places such as San Francisco, downtown Palo Alto, and other similar locations.

Early 2020, the pandemic and work-from-home shift changed the landscape with estate properties regaining interest and many sold as buyers fled city life for the privacy and space they offer.

Alternatively, 2020 did not benefit semi-urban communities like Palo Alto. While other markets on the peninsula and south bay saw a clear uptick to single family home sales, Palo Alto was mainly flat with that price-point buyer going to places like Menlo Park and Los Altos for larger homes and yards giving them a better work-at-home and remote-work lifestyle. Everyone was looking for a home office, pool, and elbow room.

The clear winner through the pandemic was single family homes as compared to condominiums and townhomes. Most buyers leaned towards extra space, private yards and their autonomy verses a development with shared amenities and close proximity to work since it was all basically closed for the year. However, I suggest paying close attention to condos and townhomes as the economy reopens and buyers recognize the price delta between the property types. At the height of the pandemic, clients would tell me the work environment had changed and they would never be back in the office, though I’m already seeing the paradigm shift back as companies are more vocal about reopening plans. With that, I’m expecting a stronger condominium and townhome market than in 2020. We are already seeing an uptick in the Mountain View townhome market with buyers preparing for office life again. Have you seen commute traffic lately? You aren’t seeing it much on highway 85, but if you visit east bay highways, it is back in force.

Spring 2021 – A Spring to Remember or Forget – depending on who you ask.

Spring 2021 has been a rocket ship in many single-family home markets and clearly hotter than other spring markets. Though now we are transitioning to summer which brings buyer fatigue and just shear exhaustion overall. I am seeing the leveling of prices and motivation has clearly slowed down with fewer offers on properties, but if homes are priced below the comparable sales they are usually getting multiple offers. By no means am I seeing a cliff, but rather a leveling-off market. Interest rates are still insanely low, and many are trying to figure out how to diversify their portfolio out of their heavy equities positions -- one of the alternative investments being fixed assets, i.e. real estate.

We have surpassed the price peaks of 2018 after the 2019 drop and I do not see a clear shift ahead. I think most people that planned to leave the valley have moved by now and there are still plenty of people coming in for job opportunities. I think the largest risks to our market are the proposed capital gains and estate tax changes that, if passed, may have a significant impact to our market in addition to inflation that seems to be taboo.

This summer I expect you will see continual market movement from equities to fixed assets to diversify holdings (i.e. stocks), continued low interest rates, and a re-opening economy with many companies phasing in-office employees through summer with some requiring it by September.

What’s Happening in the Rental Market:

It was a horrible year for landlords with many tenants either renegotiating lease terms or just moving out and leaving landlords with vacancies. I saw rental rates drop almost 15% in many markets, but it seems like a lot of that drop has come right back in the past month and I expect to see the rental market continually strengthen as we go into summer with so many people moving back for work. In addition, the cost of owning rental properties increased as tenants were home all day – I have never had so many appliances service calls and replacements! Landlords really got the brunt of it with additional wear to properties, lower rents, more demanding tenants, and the inability to evict bad tenants. Fortunately, I think the worst is behind us though there has been a paradigm shift in the rental market. According to the US Census, demand is outstripping supply, as occupancy for single-family rentals is at a generational high. That is significant – tenants prefer their own space instead of being in a shared property such as a condo. Another reason I am so bullish on quality duplex properties.

Many clients held back last year because of the uncertainty of the market, but my clients that did see the long game are sitting in a great position. Now that the rental market is stabilizing and coming back strong my phone is ringing with clients inquiring about rental properties again.

Where Do We Go from Here?

June 15th is around the corner and I know many are anxiously awaiting the new normal. For real estate, I’m expecting a more volatile summer than usual because of travel uncertainty. Typically, summer is quieter because many residents travel internationally, so the right buyer may be on vacation when a property comes to market. Since most people had limited travel the past year, I’m expecting a tremendous travel season, which I think will create instability to the local real estate market. That is another way of saying I think there is potential for buying opportunities this summer, so call me and we will keep our eyes open for you!

I hope you have a wonderful summer, have plenty of time to enjoy all the beauty our valley has to offer, and get to spend quality time with family and friends.

Let's connect to talk more about the specifics of your exact situation: