It’s been a wild summer. A surprising number of motivated buyers were out shopping and higher than average sale prices made up for most of the dropped value from 2022! In fact, sale prices across most of the valley are knocking on the door of top prices from 2021.

Increased prices were significantly influenced by one major key factor: inventory levels. There is never a time in the valley where low inventory is not a cause for high prices, but this summer was especially dismal. Compared to 2022, summer inventory was down by 31%, but more telling was the drop over the past two years by over 43%! That’s 43% fewer listings in Los Altos over the summer months than in 2021, and I’m seeing a similar drop in surrounding cities through the valley. This dramatic drop in activity has put a lot of pressure on would-be buyers in spite of interest rates being twice as high as a year ago. With so much pressure on the financial market and so much uncertainty, why would anyone want to be a buyer today? There are definitely valid reasons to be a buyer or seller in the current market, read below!

Who is buying in the current market?

One thing I love about our real estate market is the depth of buyers. It is obviously heavy with tech buyers, but there are many other buyer segments that keep our demand strong. When tech stocks were slow last year, you saw other buyers step up and fill the gap, albeit it was a short-lived gap. Below I profile today’s buyers and share the main reasons for their purchasing decisions:

The Opportunistic Buyer – if you have lived in the valley long enough, you have experienced euphoric behaviors competing for anything real estate. It is hard to compete with those buyers since logic typically goes out the window and you are left with highly emotional competition. Fortunately, that is not our market today. An opportunistic buyer recognizes this quieter environment and wants to get in before the next wave, even at higher interest rates. These buyers are making offers based on recent comparable sales and generally making adjustments for condition differences instead of making arbitrary offer prices based on factors like the number of offers, which is no gauge to actual value or final price.

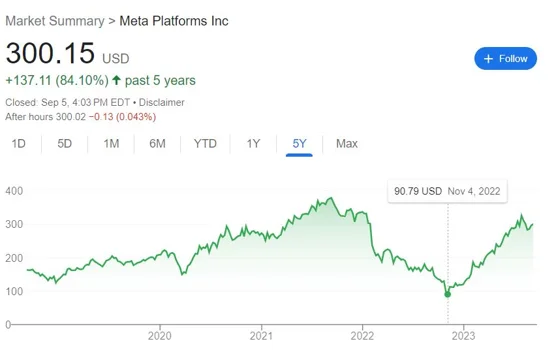

The “Time to Diversify” Buyer – The past few years have been a roller coaster in the stock market. If you were at Meta, for example, you have watched your company stock go from over $300 down to $90 and back up to over $300. That’s enough to give anyone reason to panic, and they don’t want to experience that kind of drop again when the majority of their holdings are in a single stock. I am seeing these buyers take advantage of the rebound to liquidate some holdings and diversify into real estate.

The Planner Buyer – if you have a long-term horizon, there is no time like the present. These buyers witnessed the price declines in 2022 and see this as a good time to get in. Whether starting a family or planning for the future, owning a home is a fantastic long-term strategy.

The “Return to Office” Buyer – no surprise that we are coming back to the office. For some, that means moving your family back to the mothership from across the country. Some are coming back and renting, but that seems to be the short-term plan with purchasing as the final goal.

Why would you sell today?

Financial Planning – It may be time to right-size your home (i.e. kids are off to college and you don’t need as much space or you are moving to a retirement community). There are so many reasons to right-size your home and it is especially tempting with the higher interest rates being offered for your deposits. Instead of having a large portion of your net worth locked up in your home equity, now is a unique time to sell and get a significant bump to your cash flow. This may be the best time to pivot your home asset to other financial vehicles to improve your quality of life and plan for the future.

Change in Circumstances – Life happens and you may not have a great degree of choice to time your home sale. Death, divorce, job relocation…there are many life changes that can force a sale decision even at an inopportune time.

Time to Upgrade - This is a tough pill to swallow with the higher interest rates, but you may want to upgrade your neighborhood, home size, or condition and you need the equity from your existing home. I am seeing buyers purchase an upgrade property, and many are keeping their departing home as a rental property. You may not have the luxury to keep your departing home, or you simply may not want to be a landlord. Either reason, if you decide to upgrade homes you may need to sell your existing home.

I think we are in a more balanced market today. In a sellers’ market, buyers are constantly shell-shocked with prices rising at almost every sale, so it is very difficult to get in front of the price increases. In a buyers’ market, sellers are at the mercy of buyer terms and often get quite frustrated that buyers won’t pay the same price for a comparable home that recently sold. In our market today, I am seeing opportunities on both sides of the table and more likely to see reasonable prices founded in data points rather than thin air. This reasonable market is a good place to be, but it traditionally doesn’t last long. Reasonable arguments can be made both on the market going up and the market going down in the near future, but I am bullish long-term to our local market.

What I Expect this Fall

I am expecting a solid showing this fall, just not double-digit growth. Fundamentally our market is robust despite uncertainty in the job market and financial sectors. Companies are bringing employees back to the office and generative AI is here to stay. The 3-5 year horizon is attractive in that clarity should have returned and I think we will be knee-deep in tons of exciting genAI companies driving our valley to new heights. In the meantime, we are stuck with higher interest rates for a while (I don’t think they are going down soon, unless we go into a recession) and move-up buyers are in a pinch – they want to upgrade their home but also don’t want to lose sub 2% interest rates.

I do not expect a substantial increase to inventory since I am hearing across several parts of the valley that the number of properties in preparation for sale is fairly low compared to the same time last year.

This low inventory should keep prices strong because it doesn’t take many buyers to hold up a neighborhood. Notwithstanding major changes to the global environment, I expect lower than usual inventory this fall which will keep our market fairly status quo.

If you are selling, it is so valuable to prepare your home properly to get top dollar. If you are buying, that fixer upper is free equity for the taking! On that note, check out my Instagram @realtornickfrench – I’ve been working to provide lots of valuable content and would appreciate a follow!

Let's connect to talk more about the specifics of your exact situation: