SUMMER 2022 QUARTERLY BLOG

For those that recall my spring newsletter, I wrote about the volatility and uncertainty of 2022. At that time the market was insanely hot with FOMO (fear of missing out) in full force. I told buyers not to fret because the seasonality of real estate (in addition to so many fundamental market changes) was just around the corner. Fast forward to today and the market has really pivoted slower, at least in most areas.

The irrational exuberance of buying a home at any price because there would be none tomorrow is gone, and the conversation has flipped. Now, when buyers walk into open houses they aren’t asking, “When are you taking offers,” or “Will the seller accept a preemptive offer?” Instead, they are asking, “How long has the home been on the market,” and “What is the seller’s expectation” referring to a possible under-asking offer. Oh, how quickly the tides turn.

Now this isn’t a terribly big surprise as coming into spring we had some big whammies in motion:

What’s Happened in the Last 3 Months:

Inflation Really Started to Make Headlines

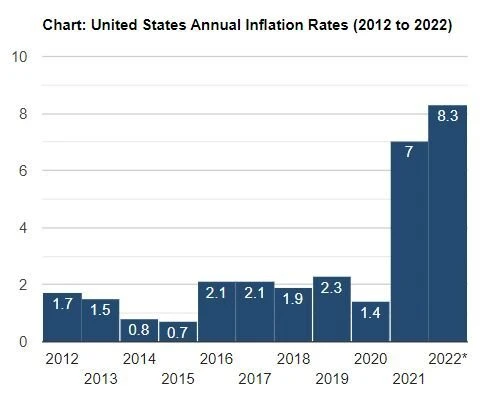

Current inflation is hovering at a 40-year high, up 8.3% over the past 12 months. This is the highest year over year increase since 1981. Some experts claim inflation is mainly due to the supply chain constraints of COVID, but inflation isn’t that simple. Once inflation takes hold it becomes its own animal and is fueled by the emotional sentiment of consumers, so taming it is very difficult and we should expect high inflation for the foreseeable future.

I know, that’s not what you want to hear, but you know me as being candid and really trying to provide you with the most accurate information to help you make sound decisions. Understanding that inflation will likely be with us for a while, we can start strategizing the best steps forward. Inflation makes life more expensive for everyone, but it really hurts those on fixed incomes. Income typically does not keep up with inflation, so as consumer costs are skyrocketing, families must make difficult decisions where to allocate funds. I noticed gasoline prices above $7/gallon the other day, highest I’ve ever seen, but I haven’t seen my vendors raise prices, yet. Even Janet Yellen, the previous Federal Reserve Chairman, admitted she underestimated inflation and it’s out of control. The Fed is currently in offensive position trying to get ahold of inflation with two main tools at their disposal:

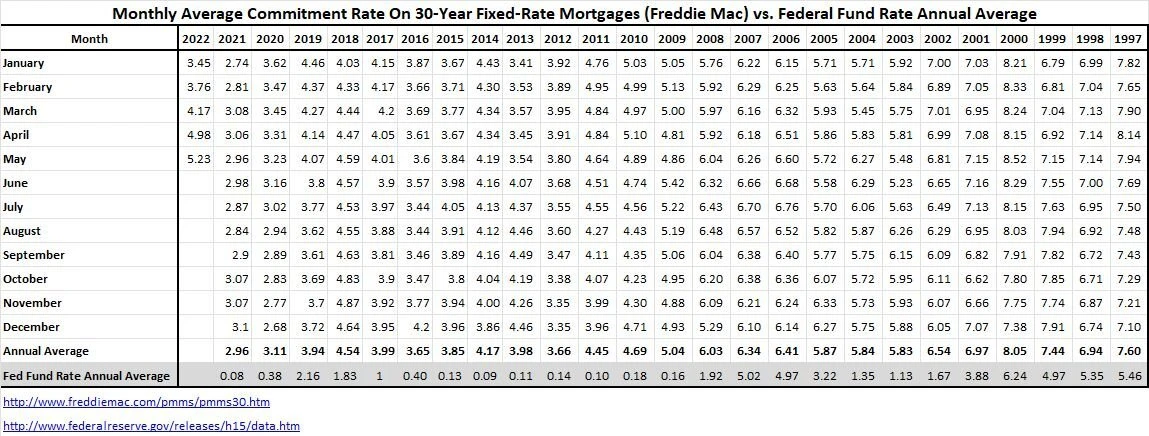

Increasing Fed Funds Rate – The Fed is continuing to raise interest rates, likely with another .5% at their next meeting in June and another in July. We have enjoyed an economic dessert for over a decade indulging ourselves in cheap money which has fueled the largest growth in equities of my lifetime. Coming out of the Great Recession, the DJIA hovered under 9,000 whereas 12 years later it peaked just over 36,000. That’s an insane creation of wealth, during which time the Fed Funds Rate gave us super-cheap money.

Cheap money fueled the stock market and real estate valuations across the country, and there was easy venture capital funding for practically any company idea. Now we must re-learn how to maneuver our financial world without cheap money. I don’t think this will happen overnight. As an example, the typical reaction I hear to current interest rates i “they are so high”, which I understand since it is quite a shock from the bottom in 2021, however, they are still insanely cheap from historical standards, so it is reasonable it will take time to get used to the new normal.

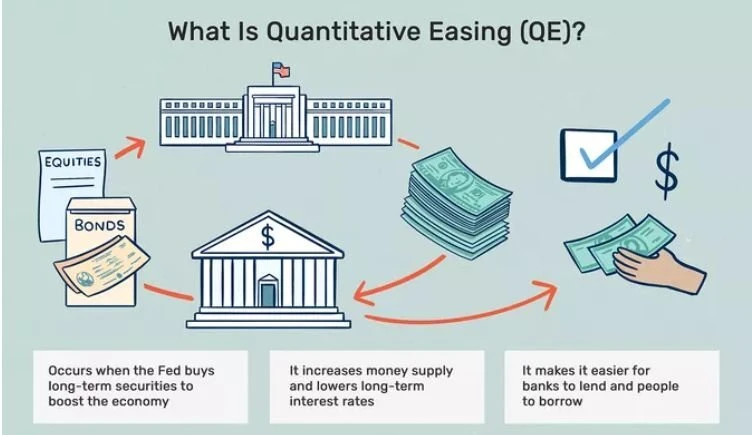

Quantitative Tightening – The Fed started rolling back its quantitative easing program, known as quantitative tightening, in order to tighten the money supply and slow inflation. The actual impact will be seen over the coming quarters and economists disagree on the outcome. Most agree investors are already soured in the equities market and so pulling back the stimulus to the equities market could push more towards a bear market.

They plan to significantly reduce their mortgage securities by selling in monthly traches for about the next 18 months with plans to evaluate impact along the way and make changes accordingly.

Increasing Interest Rates

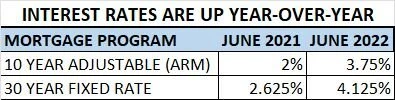

Interest rates have almost doubled from one year ago. That rate of increase is faster than most expected, including myself. At the end of 2021 I highlighted the affordability change as interest rates increased and the pressure it put on prices. We are starting to see that play out in the market as buyers’ purchasing power has significantly decreased – and it is likely interest rates have not peaked.

Interest rates have been increasing over the past several months, but it is only the past 45 days or so where I am really starting to feel it in home activity. I had a call this week from a client who has been looking to relocate but waiting to sell until they found their next home. Moving can be very inconvenient and they didn’t want to sell, then buy, since they didn’t have a good interim living situation. They wanted to know if their home is still at peak price since they are getting closer to buying their new home out of area and I had to tell them the value has dropped about 20% in the past two months. Their neighborhood has still recognized a ton of growth over the years, but it just isn’t at a peak price anymore. Buyer affordability because of higher interest rates has clearly impacted prices and the mortgage industry is saying prices need to adjust approximately 10-15% from peak to offset the increased mortgage costs.

Continuing Stock Market Volatility

Market swings in a bear market are common, so get used to it. We are experiencing that now. Just when you think we bottomed and are on the rebound, the market tanks even lower the next day. And on and on we go. It has been quite the volatile market and I know it has made a lot of people very anxious. Many clients have asked for guidance, and I’ve been working with each family on their individual needs – there truly is no one-size-fits-all solution.

Warren Buffet is having his day now boasting the importance of diversification with a focus on companies that actually make a profit, which both seem fairly fundamental but in a euphoric market, fundamentals are easily overlooked. Volatility will continue this year, but as we have seen at each market cycle, the best time to get into the market is when no one wants it. I say be the contrarian and do the opposite of the majority. If you have a long-term horizon, I’ve seen few times better then now to start dollar-cost averaging back into the equities market.

Russia/Ukraine War

We were all hoping this madness would be over now, but the longer it goes on, the worse it is for so many reasons, but most for the loss of life. Economically, it is a disaster for Ukraine who is a huge supplier of commodity goods not to mention a country in ruins that must be rebuilt. Having such a huge gap in supply adds burden to the inflationary pressures that will be continuing. But uncertainty is the real culprit to the economy. Investors hate uncertainty and the longer this tragic war continues, the longer we will live with uncertain outcomes and a longer road to recovery.

What Happens Now?

I think a recession is highly likely on the horizon. Some say we are already in the recession, since as you know a recession isn’t confirmed until we have two quarters of negative growth, but either way, I think we should plan for a recession in 2022.

Good news – recessions are part of the natural economic cycle and we will get through it – though it may come with some bumps and bruises along the way. I think we will see more about company layoffs over the coming weeks and months, and I plan to pay close attention to start-up company burn rates and runway, since I know it is getting much more difficult to raise funding and valuations are being significantly impacted. I think it is likely we will be talking about companies closing doors later this year and into 2023. I will keep you updated on this trend and how it will impact our local real estate market.

Now we need to decide your next action, whether considering selling or buying. Life happens and you don’t always have the luxury of waiting until the perfect time, but working together we can form an individualized strategy that makes the most sense for your family while accounting for market conditions.

I think real estate has a seasonal aspect during which time buyers benefit more than sellers, even in a good year. But when you consider the mass summer vacation exodus in the coming weeks after 2 years of minimal travel and the major economic changes currently underway, I’m expecting a summer of continued uncertainty with lots of buyer opportunities. The trick is finding the right situation. I am going to see a lot of sellers that want the same price their neighbor got 90 days ago and buyers that expect a steep discount to hedge additional market decline. Negotiating that right balance will be my mission this summer.

Let's connect to talk more about the specifics of your exact situation: