2002, 2009, 2018, 2022 — these are the years I experienced real estate value dips in my real estate career. I also remember the 90’s dip and have heard about the 80’s Savings and Loan crisis. I want to highlight this because when the market is humming along people forget that there are periods of difficulty. Unlike the equities market, many people don’t see the real estate drops unless they are selling at that point in time. Otherwise, they ride through the cycle and end up selling on the upside. Not to mention homes are unique relative to stocks. A share of Netflix doesn’t change whether you buy it yesterday, next month or next year — price is the only variable, unlike real estate where there are several key factors: location, natural light, floor plan, condition, smell, neighborhood factors, and so many more.

Current market uncertainty exists, but it doesn’t last forever, so how do buyers and sellers alike adapt in such a climate? There is no single path to euphoria, but I think there are clear opportunities in this market as well as landmines to avoid. Let’s get started.

Remote Work Forever!

If only I had a nickel for everyone telling me during the pandemic that they would never be back to the office. Commuting to the office — not a consideration for many. Traffic — they’ll never see it again.

Fast forward to today and the conversation is more about hybrid work, although full time in the office or hybrid model, you still need to be reasonably close to your workplace instead of in Hawaii or Montana. The new workplace rules are still being written compounding uncertainty about work and home life, but I argue we will be back in the office more than at home by the end of 2023. If you ask Tim Cook or Elon Musk, it will be much sooner. Last I heard Elon Musk said “anyone who wishes to do remote work must be in the office for a minimum (and I mean *minimum*) of 40 hours per week or depart Tesla.” I think other companies are going to follow suit, especially when company quarterly earnings miss their revenue targets, and they need to make changes to satisfy investors.

Why is where people work relevant to real estate? Because whether you are moving back to rent or to buy, more people will be coming back to the valley putting upside pressure on rental rates and home prices. Not so good if you are a buyer, but good if you are a seller.

Return to California

You saw an exodus during the pandemic and subsequently market correction, but I’ve argued this is part of the natural cycle of the valley. Each cycle you see an outflow of people whether because they are looking for a more favorable tax rate in another state, or different pace of life, but whatever the reason, it makes way for an influx of new talent hungry to live in our vibrant valley. One of many crucial pieces to understanding the valley movement is water supply. Politicians can talk all they want about the expensive housing and low housing supply, but until we figure out our water issue, there is a crystal-clear barrier to increasing population. For now, we are just trading keys as the valley ebbs and flows.

During the WFH era, secondary home markets were on fire. Utah, Montana, Texas and the like – all great places when you don’t need to be in the office, but now those markets are coming down, and quick, because many who bought during the last few years are dumping the properties as the need to return to the office becomes reality. I have been hearing several anecdotal stories from Realtors in secondary markets talking about how high-end properties are sitting on the market as the demand wains. This shift doesn’t happen overnight, but I fully expect to see more migration back to California over the next 12 months.

Recalibrating the Norm

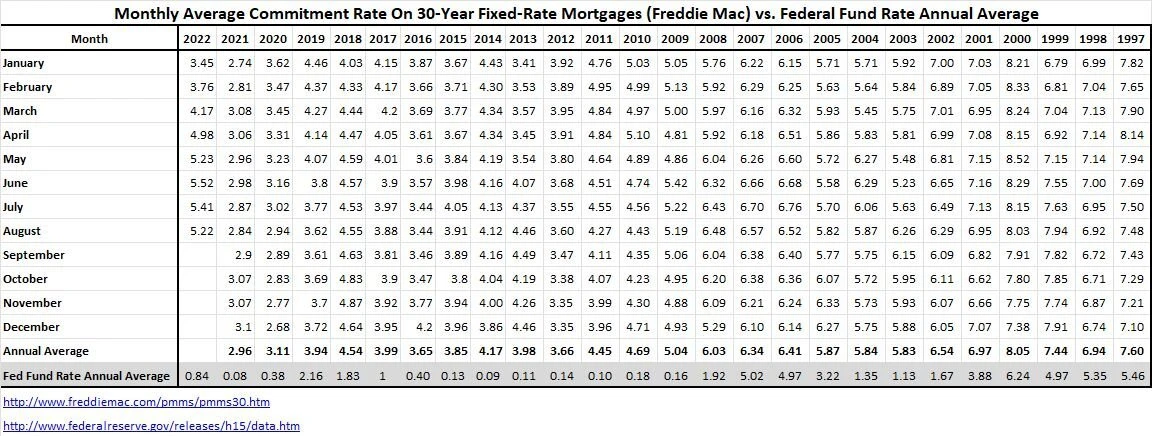

The stock market had a rude awakening last Friday when the Fed made it very clear they have no interest in adjusting their plan until inflation is tamed. It is natural people want a quick solution to the current market woes, but it is going to take time. This summer has been a period of recalibration and I am confident we will get to the market stage of acceptance, which is different from happiness. Our economy has been on the low interest rate drip for over a decade, so it’s sensible it will take some time to adjust, but once we do (and we will) we will accept and move forward. During the recalibration process you will also see a shutting of companies who lack fundamentals – i.e. lack of product and profitability. I expect to see a shakeup of companies and movement of employees into next year (and it’s already begun) because of fundamentals, but it’s all part of the cyclical process.

Real estate is no exception – Two prominent real estate companies have made headlines in the recent weeks: one who raised 100 million dollars just a year ago, burned through it and is now closing their doors; another that is in a stock freefall and the executive team is screaming real estate recession as they were unprepared for a market shift.

Real Estate Declines Aren’t Equal in All Areas

Cycle after cycle you see the same thing; our local market is extremely robust compared to other markets. It is hyper-clear we are in a market correction, but how much your neighborhood corrected depends on many factors. You are currently seeing the press talk about the market decline as if it just happened, but it’s old news. I even saw an article that talks about a pending market correction nationally, but I’m already seeing 20% price declines from peak in some neighborhoods and for many, I do not think the decline is over. Purchasing power and the stock market correction has really impacted prices, but we still have a strong market because of employee strength and salaries.

One of my clients planned a move to Nashville earlier this year, but after seeing signs of a market shift, they decided to sit back and watch the market against the Nashville Realtor advice, and they are glad they did. I don’t think most areas have reached their bottom prices yet whereas I think our neighborhoods have already taken the biggest whack in values (10-20%, respectively).

Are we at the bottom? Nobody knows, but we do know that summer is more buyer-friendly than seller-friendly, so this summer was a double whammy. The longer we go, the more comfortable people will be with the overall market sentiment and coming into fall you typically get a more seller-favorable market, albeit it won’t be like the last several years. As I think about history and how current variables can impact the market, notwithstanding other major global changes, I think by early next spring you will see a better seller’s market than we have now. Don’t expect the euphoric prices from early 2022, but better than this summer

Buyers’ Notes:

It’s a tricky time to be in the market: do you buy now or wait for clarity? That’s a loaded question because once it is clear for you, it will likely be clear for many. Over the weekend a client told me they are hoping interest rates will go down soon to help their purchasing power. I quickly told them I disagree because if interest rates changed now to materially impact purchasing power, I think you’ll have a quick shift with more aggressive buyers back to market, whereas now it is more reasonable, and buyers have a bit more breathing room. Additionally, you can look at data to determine property values instead of some buyers that pull a price out of thin air and the reasonable buyers stuck looking around wondering why someone paid so much money for a particular home.

So, when do you get into the market and purchase a property? Real estate isn’t the stock market, so you can’t put a pin on a date and say I will buy then – the home you want may not (and likely won’t) be available at that exact time. You need to be more opportunistic when the right home comes available, but fortunately, in a market like today, you can be more particular (within reason) and buy the right home rather than buying good enough. If you buy the prime locations, you will see that they hold up the most in a market correction. For example, I am seeing about a 10% drop in Palo Alto and Los Altos, but other areas are seeing 20% or more correction. I expect outlying areas and farther to go well into the 30% plus correction territory. But be aware, you will not see these percentages when you’re looking at aggregate data since the average doesn’t swing as drastic. You will see it in like-for-like home transactions, so it is important to be knowledgeable and an expert in your market place.

Sellers’ Notes:

Don’t beat yourself up for not selling at the peak. You can’t time the peak, but you can time diversification and long-term strategy planning. If you are considering selling, you want to be aware of two immediate factors:

- Higher interest rates hurt sellers because buyer affordability drops and impacts purchasing power. The buyer still has the same monthly mortgage expense (or higher) at the new market price, but Sellers put less in their bank account at closing. So buyers aren’t getting a better deal on a monthly basis, they too are feeling the market pain.

- Buyers are dipping their toes in the water, but not sure if they should jump in [the market]. Every seller should be hyper-aware of the current climate and have the mantra of getting buyers to Yes. I have noticed when buyers walk into homes today they are usually looking for reasons to say No, instead of finding their way to Yes. Previously, Yes was easier to reach because buyers were much more motivated in an accelerating market. Now that we have tipped and are still finding our footing, buyers are much more cautious and getting to Yes is much more difficult.

The key to Yes is in the home preparation. I’ve said it before, but it’s never been as important as now for homes to show their best angles. Homes are selling, but move-in ready homes that are attractive are much more desirable. Projects are daunting in any market, but for many even worse now because of:

- Finding a competent contractor

- Involvement and stress during project

- Supply chain issues for materials

- Carrying cost during project

We are in a dynamic market, so if you are considering buying or selling, you want to have a great navigator that understands the multitude of perspectives and can help guide you properly. I believe in being an advocate for my clients and during this market transition I think it is evermore important. Not everybody should buy or sell today, but there are also great reasons to buy and sell, it just depends on your individual circumstances.

Let's connect to talk more about the specifics of your exact situation: