FALL 2021 QUARTERLY BLOG

Whether you are buying a bag of potatoes, building a fence, investing in the stock market, or buying real estate, everything is expensive right now. Everything, except interest rates.

The past few years has been an economy driven by free money through the global economic re-opening, which has shot up inflation even though some say inflation is temporary due to the COVID recovery. That leaves the elephant in the room – how do we proceed in such a climate?

My advice? Proceed with cautious optimism. – We are back to a euphoric state where any investment seems like a good investment since every asset class seems immune to a correction… for now. A seasoned investor once told me, “It’s easier to make money that to keep it,” illuding to the fact that a few bad investments can ruin a portfolio.

How do you proceed and live life in such a reality while making prudent investment decisions for your family and portfolio? I want to break down some of the current concerns on my mind and how I am operating in such a world, but first I must address what’s happened over the past quarter. Free money isn’t forever, so we want to seriously consider what happens when interest rates increase, and money starts looking for the next bet.

Summer Market 2021 Recap

A typical summer market includes lots of international travel out of our valley, so the buyer pool is thinned out. This summer I was expecting a mass exodus of vacationing and we had a lot of travel, locally and to Hawaii, but the delta variant kept international travel to a minimum, so the summer market was much hotter than previous years. It’s hard to believe that our summer continued a rocket ship pace only to finally start slowing the trajectory the past several weeks. When people hear slowing, they often think the market is cooling, but it is more a flattening while staying at the new peak averages. The past several weeks I’ve seen the number of offers decline dramatically and many listing agents have said they felt lucky to get a few very high offers – I can’t help but wonder, if just those few people slept in that day, the sale price would look very different.

Early summer included a month or so window where people got excited to be re-opening and even had early summer parties without masks – the Vaxed and Waxed parties. But quickly, the delta variant changed it, again. We even had our annual party on the calendar for October and had been asking around – most people I asked were excited and said they would come to an indoor October party. I asked the same people after delta started spreading and all of them said “probably not.” Hence the party is canceled (again) this year as well (I’m very bummed about it) but it is an example how delta changed family plans this summer.

So, people did the next best thing – went Open House shopping! There are currently more active buyers in the higher-end market than I can remember. One of my colleagues had a brand-new home listing this past week and had over 200 visitors for a $6m home – that’s a lot of competition in the same price range, but buyers are always at various stages of the purchasing process, and I think most have some hesitation right now.

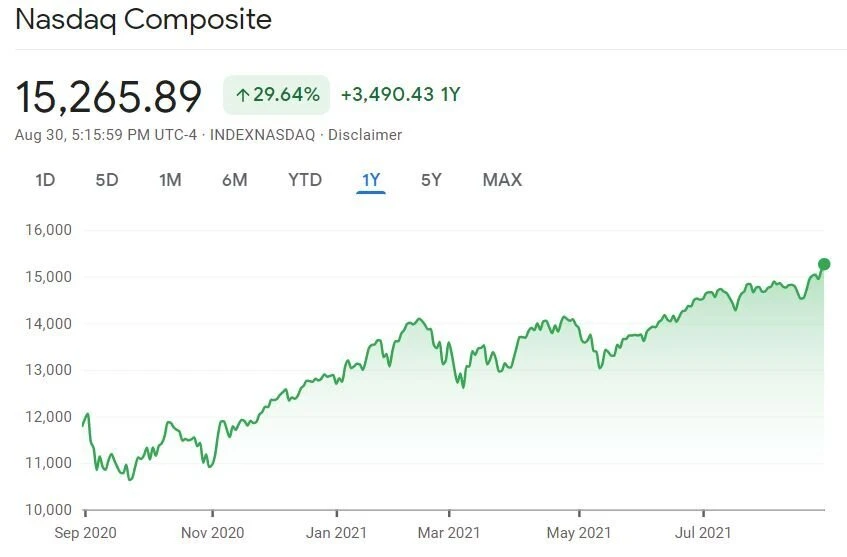

NASDAQ

At all-time highs, again! Just in the past 3 months since my last newsletter is has increased by over 11%.

That’s an insane increase in just a few months. But money is looking for a place to invest and low interest rates continue forcing money into the market. In June I discussed how I expected market movement from equities to fixed assets, like real estate, to diversity holdings. That’s exactly what I’m seeing. Most of the homes I’m seeing transact have large down payments from stock sales and one of the reasons they are liquidating holdings is to diversity the portfolio – take some gains off the table.

But there is still a ton of money in the market because there doesn’t seem to be a better place to put it – There is a contingent that tells me their stocks never go down, so they don’t plan to sell, but there is a cautionary story to be told. I think 2022 will be less predictable with interest rates and the equities market, and a prudent investment strategy is to be diversified.

Rental Market

Last year was tough for landlords and hesitation to purchase investment properties continued because of the lack of clarity on tenants’ right,, ability to pay, evictions, and the like. Investment properties have started a strong rebound now that there is a clear path for renters to pay rent. Last year many people hesitated to buy investment property since so much of the news was about renters not paying. My clients that bought rental properties have seen 20% plus gain in less than a year! In the past few weeks I’ve seen multiple offers on basically every investment property I’ve looked at. I think that goes to the diversification point earlier.

Current Concerns

“The market is so hot – everything is selling 10% over-asking!”

I’m going to let you in on a real estate listing secret – shhh! If a house goes over-asking what you should ask next is: was the listing price reflective of the current market value? For example, I showed a Sunnyvale home last week and the home was listed $500,000 under the same floor plan that sold 30 days prior just around the corner. When speaking to the agent he fully understood he priced it that much under to generate tons of activity and drive the price. So if that house sells $500,000 over the asking price, is the market hot, or was it just underpriced and a buyer decided to pay the same as a comparable 30 days prior?

|

|

The listing game is to price a house to generate irrational exuberance and get buyers to pay whatever it takes to get it – and it sounds good when you can advertise your listings go so much over the asking price. I often hear people say all homes go 10% over asking, which is flat out not true. As a listing agent, you have to be very keen on buyer expectations and if that’s what the buyers expect, you’ll see listing prices come on 10% under recent sales. It’s a mental game that’s being played out and it does bite, so be careful.

What happens when the Fed starts tapering?

The chatter around Wall Street now is the imminent tapering the Fed will likely start in November. Also known as quantitative easing (from the 2008 recession), this is the government program to buy about $120 billion a month in Treasury bonds and mortgage-backed securities. This program, along with near-zero interest rates, has fueled the bull market as well as real estate bump, but it will start winding down and the question remains, how investors will react. Following the previous tapering in 2013, there was a sell-off in the market and a re-allocation of stocks, so watch for movement.

How does the delta variant impact our local real estate market?

When COVID closed our economy, it decimated the condominium and townhouse market – every buyer wanted the same thing – they did not want to share air space with others, they wanted yards, home offices, and some elbow room. Commute was also less important so all those great communities near tech centers weren’t as demanding. Once the vaccinations rolled out, we started seeing a pickup to condos and townhomes and had a few strong sale months, but then delta variant got going and companies that had late summer plans to re-open pivoted. With the pivot to re-opening, so did the condo and townhome market. For example, there is a great development close to Google that had a clear bump in price April through June, but once the variant was clearly an issue by early July, I saw a clear slowing to that market.

Is it a good time to buy or sell a home?

That is the real question, but unfortunately doesn’t have an obvious answer. I don’t believe in the cliché it’s always a good time to buy or sell, but I do believe there are reasonable reasons to consider both options at a given time. I’ve found it’s more person/family specific and part of a larger plan. I think a sensible person will buy or sell in any market, but that is not the same as it being good for everyone to buy or sell at any time. For example, maybe siblings are selling the family home after the parents pass and there may be tax-advantageous reasons to sell at a specific time, which may not be the ideal selling time. Or a family is buying a home because their children are starting school and they want consistency for their family – it’s quite unfortunate when a landlord tells a family they must relocate to a new home, especially when there are school-age children involved. What I can say with certainty is the local real estate market for single family homes has generally been on a terror the past few years, as with the stock market, so you are seeing some big gains in a short amount of time.

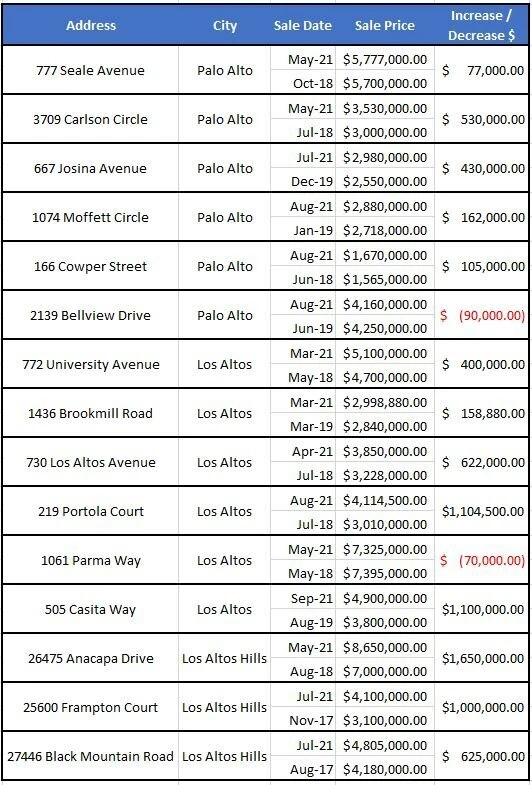

It’s easy to look at large data sets and see how the prices have changed, but I find it much more valuable to look at like-for-like sales to give me a snapshot of market movement.For example, over the past several years there have been a handful or properties that have resold in similar condition to the previous purchase, so you can see a good picture of how the prices have changed:

Let's connect to talk more about the specifics of your exact situation: